Table of Contents

Monte Carlo Simulation Stock Trading Systems

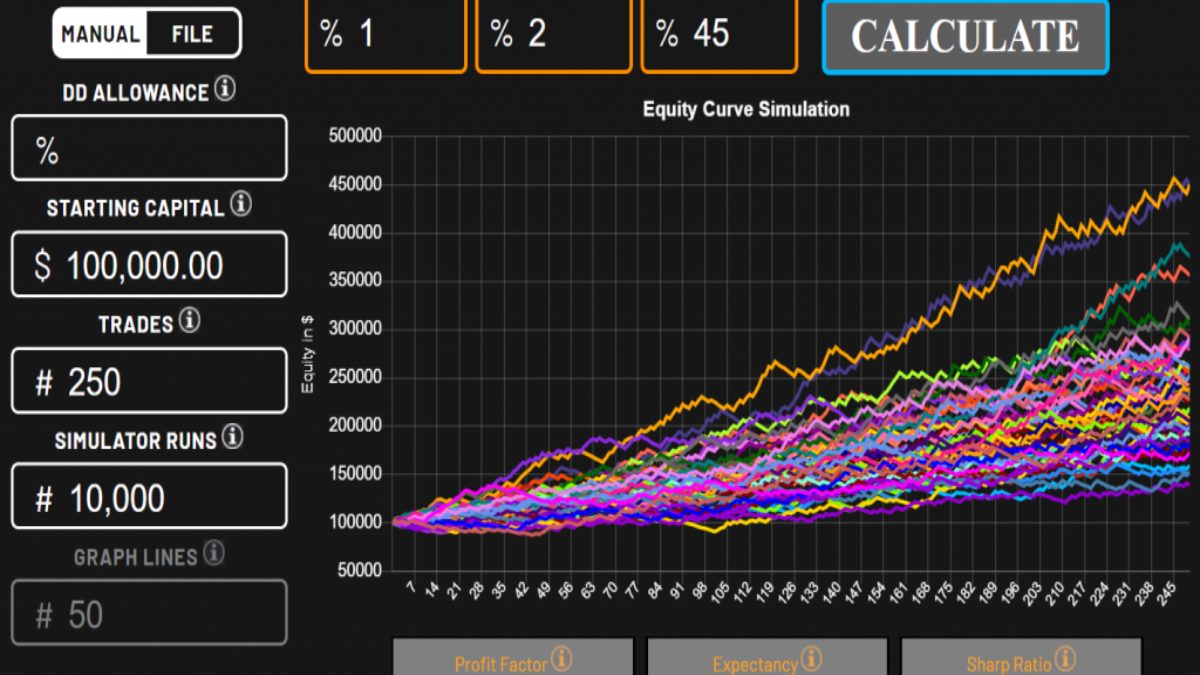

The Monte Carlo Simulation Stock Trading Systems uses the historical returns of your trading strategy to generate scenarios for the returns of the future system. It offers a visual approach to volatility and can overcome the limitations of other statistical methods.

Monte Carlo Simulation Stock Trading Systems Simulation

Monte Carlo is synonymous with a random process like the numbers from a roulette wheel.

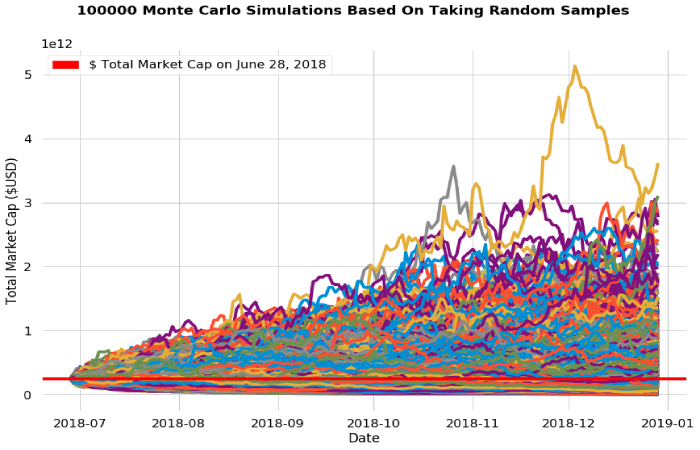

The Monte Carlo simulation does the same for the extremes of your historical strategy. You randomly rearrange them to generate new results for your trading strategy.

aLSO, Monte Carlo Simulation Stock Trading Systems significant features of the original statements are preserving. E.g., P / E ratio of operations, duration of operations, flat periods, outline operations.

Classic statistics such as standard deviation sometimes have trouble capturing these properties and thus lead to incorrect results, such as underestimating the future volatility of returns.

Using the Monte Carlo stock forecast provides new indications of volatility and expects the performance of strategies.

Also Read: Türkiye Millî Futbol Takımı – Lüksemburg Millî Futbol Takımı Maç Kadrosu

Returns Resampling

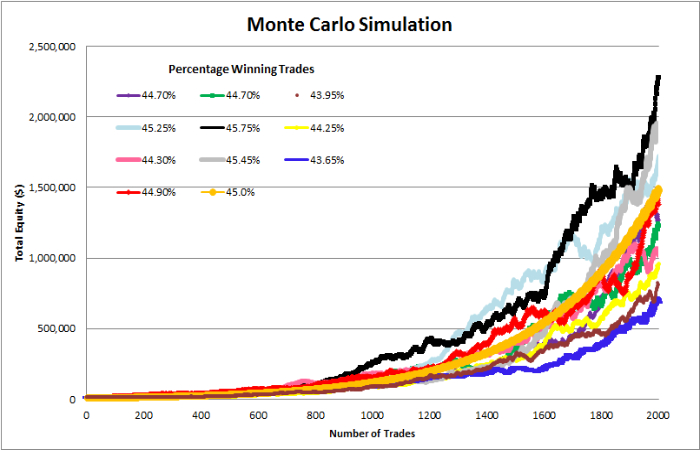

The Monte Carlo simulation uses historical returns to produce stock forecasts; E.g., Instead of its historical returns of +5, -1, +6, -3, +2, Monte Carlo could lead to a series of 2, -3, -1, +5, +6. Both would have the same absolute benefit but different statistical properties. However, Series 2 has a higher total loss than its original returns, indicating that you have been lucky in the past and want to prepare for more volatility in the future.

Loss Of Advantage

As we all know, backtesting results generally cannot be fully archived in the future. It is due to over-optimization and curve fitting, which cannot be avoiding entirely. With real-time trading, expect smaller profits and more considerable losses compared to the backtest results.

To account for this effect, I added a damping factor to the Monte Carlo simulation indicator. For example, put 10%, you will reduce your winnings by 10% and increase the size of your losses by 10%. It leads to a lower absolute return and higher volatility of the generated stock curves.

Compare the diagram below and the diagram above to see the difference. In the chart above, future scenarios have the same advantage as historical returns. In the graph below, the prospective benefit is reduced by 20%. As you can see, this significantly increases the volatility of possible future profitability trajectories.

Trade Signal Indicator Code

Below is the link to the indicator code for the Monte Carlo simulation. Drag and drop this indicator onto a chart containing an algorithm trading strategy.

You can generate a new simulation through the updates inbox. Apply the indicator multiple times on the same chart to get a chart like the one shown above.

Portfolios Of Monte Carlo Simulation Stock Trading Systems

Also, the hand with portfolios. Configure pyramids in Money management; otherwise, simulation errors may occur.

The indicator can be used free of charge for all non-commercial purposes. It can contain errors and produce unexpected results. You can redistribute and modify it under the terms of the GNU General Public License publishing by the Free best Software Foundation, either version 3 or (your choice) a later version.

Also Read: What is Buisness, Definition, Concept, Types, and Categories Essentials

All About Marketing Opening, Jobs, Vacancies and Salaries

All About Digital Marketing Jobs, Openings, Vacancies, and Salaries